Johnston Press has completed a financial re-engineering project which has enabled it to cut its debt by a third to less than £200m.

The money was raised by issuing 4.5bn of new shares at 4p a share and issuing a fixed-rate bond for £225m over five years.

Johnston Press chief executive Ashley Highfield told Press Gazette last month that the cost of servicing the company's debt will go from somewhere in the high-£30ms (at a 12 per cent interest rate) to somewhere in the high-£10ms (at a 9 per cent interest rate), meaning JP will be saving £20m a year in interest payments on its debt.

He said the refinancing will allow Johnston to invest more money in journalism.

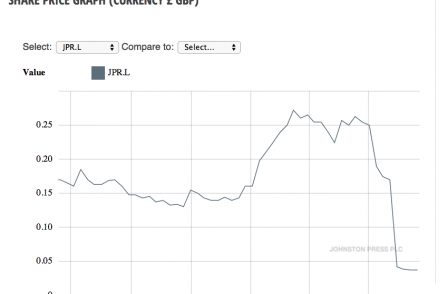

The Johnston Press share price currently stands at 4p, down from 25p in April.

The creation of so mony new shares at such a cheap price was expected to bring the price down. Highfield had predicted that the share price would drop to 4.8p. This morning the Johnston Press share price stood at 3.7p.

Johnston Press said in a statement: "Johnston Press plc is pleased to announce the successful completion of its Capital Refinancing Plan (announced on 9 May 2014).

"Gross proceeds of £140 million have now been received by the company in connection with the placing and the rights issue, and further to the announcement made by the company on 14 May 2014, gross proceeds of £220.5 million from the offering of £225.0 million 8.625 per cent senior secured notes due 2019 at an issue price of 98 per cent have now been released to the group from escrow.

"All amounts outstanding under the Existing Lending Facilities have been prepaid and cancelled in full, the Private Placement Notes have been redeemed in full, and the New Revolving Credit Facility has become available."

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog