Growing profits and turnover at The Economist suggest it has found the answer to the loss of advertising which is hitting most UK news media.

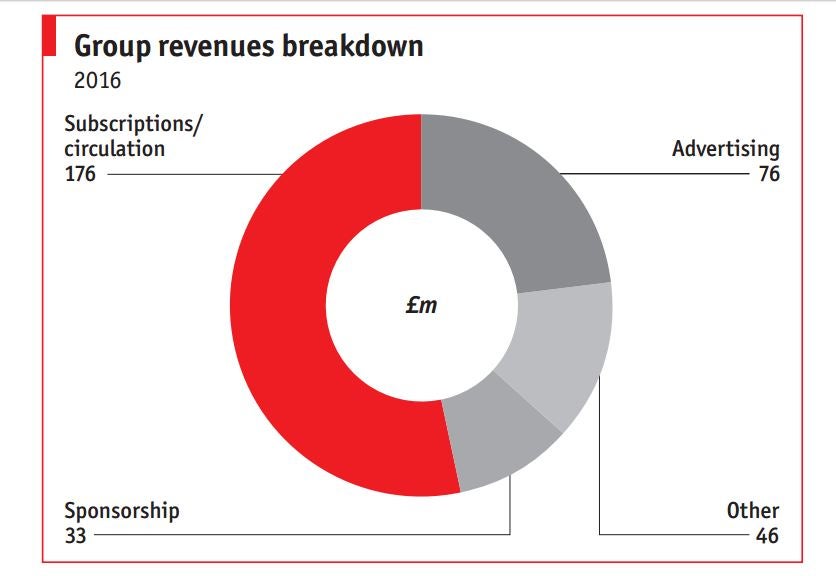

Print advertising income at The Economist dropped from £118m in 2009 to £47m for the year to March. But the group has revealed pre-tax profit up from £59.3m to £60.6m and turnover up from £324m to £331m.

This came largely from a 31 per cent increase in circulation profits. This was achieved by marketing new subscriptions, shifting existing customers away from discounted deals and selling premium print and digital packages.

The global digital and print circulation figure for the weekly magazine now stands at just over 1.6m, with subscriber numbers up 3.5 per cent year on year.

While many newspapers currently see social media giants such as Facebook as a huge challenge to their business models (see comments from Guardian editor Katharine Viner) by taking away advertising, The Economist claims to see them as an opportunity.

Deputy editor Tom Standage said in the The Economist Group annual report: “Publishers face two main questions in the fast-moving world of digital publishing: how to make money, given that business models based on display advertising do not seem to be sustainable; and how to respond to the emergence of new distribution platforms, such as Facebook Instant Articles, which can deliver large audiences but require publishers to make their content available in environments they no longer own or control.

“Our answer to the first problem is quite simple: most of our revenue comes from print and digital subscriptions, not advertising, so the rise of ad-blocking and the diversion of advertising spending away from publishers and towards Google and Facebook harms us less than most.

“We also have a simple answer to the second question. We consider new distribution platforms, such as Apple News and Facebook Instant Articles, to be a logical extension of our existing social-media efforts, which we have stepped up this year

“We now have a team of ten writers and editors promoting our output on a growing range of social platforms. We have over 17m followers on Twitter and 7.7m on Facebook, and 1.8m on LinkedIn. Our posts on social platforms encourage new readers to sample our journalism.

“But our aim is always to drive them towards our own website and apps, where we can encourage them to become subscribers. We give away a limited number of articles on distributed platforms as part of this strategy, but access to the full breadth of our output still requires a subscription, and always will.”

Last year Pearson sold its 50 per cent stake in The Economist Group to existing shareholders for £469m.

The report reveals that editor Zanny Minton Beddoes is the second best paid Economist director, with annual salary and benefits of £343,000.

The top paid member of staff is chief executive Chris Stibbs on £448,000.

The Economist employs 1,363 staff and makes most of its money from customers in the US (where it has its biggest circulation). Some £55m of turnover comes from customers in the UK, versus £162m from North America, £49m from Europe and £46m from Asia.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog