Specialist publisher Future almost tripled its pre-tax profits last year and is now planning further growth with its proposed acquisition of magazine publisher TI Media.

Future, which owns some 130 brands, reported a pre-tax profit of £12.7m for the year ending 30 September 2019, up from £4.4m the previous year.

The company announced today that its revenues grew by 70 per cent from £130.1m to £221.5m.

It also reported an operating profit of £26.7m, up 404 per cent from £5.3m in 2018.

Future chief executive Zillah Byng-Thorne (pictured) said in a statement: “Future has had an outstanding year. Our strong financial results provide clear evidence of the continued and effective execution of our strategy, leveraging our technology platform across all our brands to diversify our revenue streams.

“Our acquisitions during the financial year – two specialist cycling brands, Mobile Nations and SmartBrief – have significantly broadened and strengthened our B2C and B2B portfolios and materially increased our US presence.”

Byng-Thorne added that Future’s current financial year has started “very positively with continuing strong growth”.

The company said it expects to complete its £140m acquisition of TI Media in the spring once the Competition and Markets Authority concludes a review of the deal.

The buyout would mean Future owns more than 220 brands globally, taking on titles like the now digital-only Marie Claire, Woman and Home, and Horse and Hound.

Future also revealed it has bought video content production agency Barcroft Studios for £23.5m as it continues to offset falling print revenues by chasing new audiences online.

Future’s print magazine division saw organic revenues fall by ten per cent to £47.9m, which the company said was in line with expectations.

When acquisitions were included, magazine revenues grew four per cent to £66.6m.

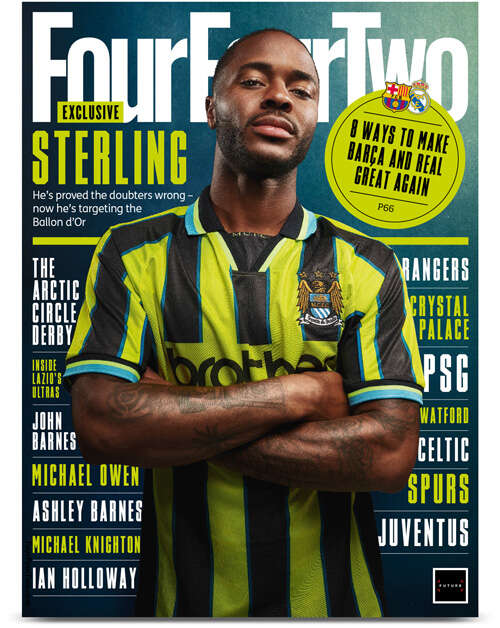

This growth was largely driven by the acquisitions of Music Week publisher Newbay, four specialist consumer brands from Haymarket including Four Four Two, and of Procycling magazine from Immediate Media.

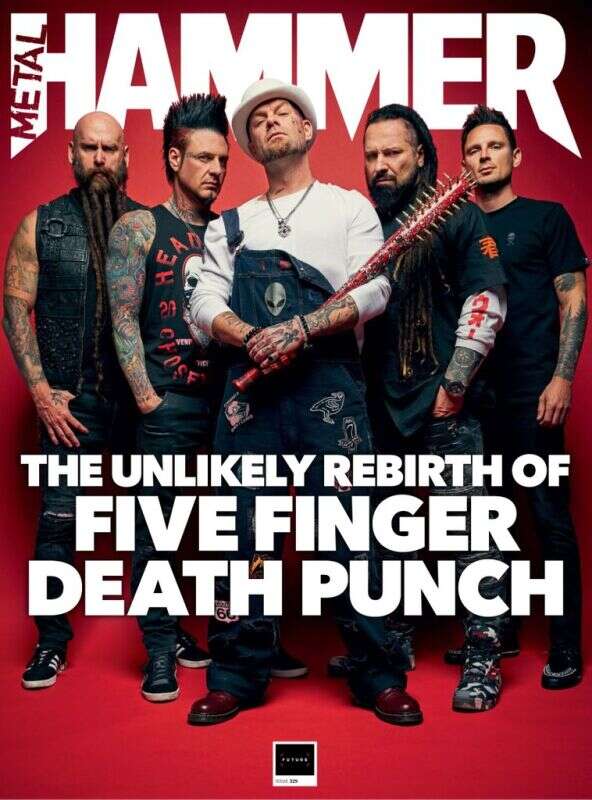

Byng-Thorne told Press Gazette Future’s most successful magazines last year were those in its home interest portfolio and Metal Hammer.

The media division, which includes Future’s online titles and brings in revenue from ecommerce (affiliate links), digital advertising and events, grew by 32 per cent, “significantly offsetting” the decline in magazines.

In particular Games Radar and PC Gamer both saw significant audience growth year-on-year, Byng-Thorne said.

The group’s total online audience increased by 44 per cent or 31 per cent in the like-for-like portfolio.

As of 30 September, Future derived 70 per cent of its revenues from the media division with the rest coming from its magazines.

Asked if there were any plans to close magazines and focus on online revenues, Byng-Thorne told Press Gazette: “None at this stage.”

“We would never think about it like that, as in let’s close the print to focus online,” she said.

“What we think about instead is how do we serve the community? And so if people in the verticals that we write content for want to buy magazines then we’ll publish them.

“What the debate’s much more about is we don’t want brands that lose money because we all work too hard to lose money. So if a brand, be it an event or a magazine or an online brand, was to not be able to generate enough revenue to be able to pay for its overheads then we would consider it.”

Byng-Thorne said buying TI Media would add a large female readership to Future, which is currently skewed towards male audiences with a number of gaming, technology and music titles.

It will also help Future to “further leverage our proprietary technology platform and develop new digital monetisation models”, she said.

Byng-Thorne confirmed Future is hoping to expand some of TI Media’s brands, but said she had been unable to speak to their staff about particular titles yet due to the CMA review.

She said: “The opportunity with TI Media is they are very well established in the UK but they didn’t have presence outside of that, whereas we have significant infrastructure in the east coast of the US and also in Australia so our view is to use that UK engine to then fuel the international expansion.”

Just over half (54 per cent) of Future’s revenues, and 67 per cent of its media revenues, currently come from the US.

The acquisition of Barcroft Media, for which contracts were signed yesterday, will allow Future to create better video for its titles and amplify their Youtube and social media presence, the company said.

Byng-Thorne said the deal would allow Future to futureproof its audience, adding: “We definitely think that mobile continues to be a predominant source of content readership and we also think with the dawning of 5G video will continue to grow and there’s a generation of millennials who are video first, written word second.

“Our business historically has been quite written word heavy and so by buying Barcroft what we’re buying is an engine that offers content at scale and video which helps us futureproof the business.”

Barcroft Studios chief executive Sam Barcroft said in a statement: “Combining Future’s world-class editorial teams and iconic media brands with our expertise in the creation and distribution of amazing TV and video is an exciting proposition.

“We have so many things in common, not least that journalism and innovation is also in our DNA, and we’re excited to be taking our next step forward as part of Future.”

Picture: Future

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog